|

Treasury Macro Model Kenya (KTMM)

This part is based on the Paper to Seminar

7, November 2002, in The Hague.

This paper is very short,

full documentation is in the model file itself: See for the

theory behind the behavioural equations the sheet THEORY in the

model file: KTMM.xls. That model file also contains a sheet MANUAL.

|

Table of contents:

Click here to download the word-file of this document.

|

Visit 3-10 November 2002 of two KIPPRA economists to MMC in The Hague

Background:

In January 2000 did start the

EU Project nr. 7 ACP KE 080, Institutional Support to the Kenya

Institute for Public Policy Research and Analysis (KIPPRA) by ISS/MMC.

In this project Micromacro Consultants (MMC) has supported the

construction of the macro model, and -once the operational version was

running- the use of the model for Budget forecasting, Policy Analyses

and Research. In this project MMC used its Macroabc methodology (that

has been applied also successfully in Curaçao, Suriname, Poland,

EU15, The Netherlands and Indonesia, see www.micromacroconsultants.com)

and telework approach: MMC bring short visits to Kenya, Kenyan

economists follow short training visits at MMC in the Hague, and in

between co-operation by telework.

Target:

The target of this additional training visit of KIPPRA economists to The Hague is:

- Increase the experience of KIPPRA economists further in using the macro model for policy and historical variants analysis.

- Provide KIPPRA economists with ideas for further improvement of the KTMM.

- Model improvements

Participants: Two economists of KIPPRA Kenya:

- Dr. Stephen Karing

- Ms. Maureen Were MA

MMC consultants who have been involved in this project:

(* involved in this visit, ** did also visit KIPPRA in Nairobi):

- *Dr. Marein van Schaaijk** (director MMC, Macro model manager)

- *Dr.

Free

Huizinga**

(specialist macro model theory)

- Drs. Laurens

Harteveld

(economist, assistant to project director, MMC)

- *Drs. Bas van

Tuijl

(economist, assistant

to project director, MMC)

- Drs. Runy

Calmera

(Curalyse, macro model

Curaçao)

- *Dr.

Jan

Donders

(head short term division CPB)

- Drs. Bjorn van

Hamel

(retired CPB, MMC consultant Indonesia)

- Drs. Cees

Jansen

(expert in fiscal and macro monitoring)

- Drs. Ate

Nieuwenhuis

(specialist in prices analysis)

- Dr. Herman

Stolwijk

(model builder, agricultural expert)

- Dr. Andrzej

Tabeau

( MMC consultant Polish Macroabc)

- *Dr. Johan

Verbruggen

(model & short term, head Short term Div. CPB)

- Drs. Michiel

Vergeer

(Fiscal expert, MMC consultant Indonesia)

- Drs. Eugene

Verkade

(macro models Indonesia and India)

- Dr. Dirk van der

Werf

(macro model builder, revenues government)

- Drs. Gerard van Welzenis (international monitoring expert CPB)

Organization of the training visit at MMC’s office:

The training is organized by

workshops in the morning and model training and improving sessions in

the afternoon. These afternoon sessions most of the time will be done

with the whole group with a PC with big screen, and some training will

be done individually and each participant will have a PC at his

disposal.

Time table Workshops 4-8 November at MMC's office in The Hague:

9.30-13.30 discussion meeting (workshop) 9.00-9.30

participants prepare workshop,

13.30-17.45: participants

prepare workshops and improve their model

Day

|

Subject

|

Expert

|

S 3 Nov.

|

Arrival of the participants

|

|

M 4 Nov.

|

Policy & Historical

simulations

|

Dr. Marein van Schaaijk

|

Afternoon:

|

CPB analyses: even more than

macro: micro sectoral, etc.

|

Dr. Free Huizinga

|

T 5 Nov.

|

Short term forecasting at CPB

|

Dr. Johan Verbruggen

|

Afternoon

|

Poverty Module to

Curacao

Macroabc

|

Dr. Marein van Schaaijk and Drs.

Bas van Tuijl

|

W 6 Nov.

|

Monitoring monthly CPI, exchange

rate, interest rate

|

Drs. Bas van Tuijl

|

Afternoon:

|

cost price (including indicator

self-employed): re-estimation, variants, model improvement

|

Dr. Marein van Schaaijk

|

T 7

Nov.

|

Macro Theory

|

Dr. Free Huizinga

|

Afternoon:

|

16.00-17.30 Seminar at ISS

|

|

Evening:

|

Fare well dinner

|

|

F 8

Nov.

|

Macro & Fiscal models: how to

cooperate?

|

Dr. Jan Donders

|

Afternoon

|

Historical simulations; research

agenda

|

Dr. Marein van Schaaijk

|

S 9

Nov

|

End of this visit

|

|

|

KTMM seminar at ISS Thursday 7 November

SPECIAL ECONOMIC RESEARCH SEMINAR

7 November 2002 16.00-17.30

Kenyan Model (KIPPRA) model seminar:

Title: ''Presentation of the KIPPRA-Treasury Macro Model Kenya:

discussion of theory behind, demonstration about how it runs and base

line and policy simulations".

Chairman: Rob Vos (ISS)

Discussant: Jan van Heemst (ISS)

The model, labeled KTMM, has been developed as part of the

KIPPRA/ISS/MMC project in 2000 and already has been used

intensively for the preparation of Budget Papers, the Medium Term

Economic Framework, a Poverty Reduction Strategy Paper and the

Development Plan.

- Presentation of KTMM theory by Dr. Stephen Karingi (KIPPRA)

- Presentation of KTMM consistency framework by Dr. Marein van Schaaijk (MMC)

- Presentations of Variants Paper by Ms. Maureen Were MA (KIPPRA)

Papers to be discussed:

- ''A Better Understanding of the Kenyan Economy: Simulations from the KIPPRA-Treasury Macro Model" by Maureen Were and Stephen Karingi, Discussion Paper KIPPRA, August 2002

- "Introduction to KTMM". Paper can be found on www.micromacroconsultants.com

|

Documentation to KTMM

- A review of old models: Macro Models of the

Kenyan Economy: A Review, by Karingi S. Njugana and Njugana S. Ndung'u,

January 2000, KIPPRA D Paper no.2.

- A general theoretical underpinning of the

behavioural equations, based on the theory behind the Polish Macroabc

and discussions at KIPPRA. Improved version below.

- Report on Macro data needs for the KIPPRA Macro

Model and a work plan how to realize an operational version of the

KIPPRA Macro Model in August 2000: Macro Model Work plan (Annex B and C

to Inception Report)

- Draft Consistency Framework for the KIPPRA

Kenya Macro Model and the provisional macro database, KTMM note 5,

February, improved version note 6 March 2000. With attached disk with

model file.

- The paper: ''Draft Estimation Procedure and

Estimated Results of the KIPPRA-Treasury Macro Model'', April 2000. The

paper describes each of the 12 behavioural equations: specifications

and coefficients based on the initial theory paper and

estimation/calibration results for 1972-1999.

- The paper KIPPRA-Treasury Macro Model Kenya,

Database and Consistency Framework, based on MMC's Macroabc

methodology, April 2000, including documentation in sheet Manual and

CDROM with data and model files and multi-media self explaining

slideshow to the model.

- The Paper KTMM and Proceedings Workshops June 2000

- The Paper KTMM Workshop, Nairobi August 16-17, 2000 with model overview.

- Paper to seminar at ISS 6 July 2001: ‘’The Kenya model KTMM’’

- The Paper ‘’Kenya’s exchange

rate movement in a Liberalized Environment, An empirical

Analysis’’ KIPPRA Discussion Paper DP/10/2001

- The Paper ‘’Theoretical Base for

the Kenya Macro Model: The KIPPRA-Treasury Macro Model, KIPPRA

Discussion Paper 11, October 2001.

- The Paper KTMM Study Module +CDROM, March 2002.

- The Paper Kenya Variants Analysis Training MMC, June 2002.

- The Paper: ‘’A Better Understanding

of the Kenyan Economy: Simulations from the KIPPRA-Treasury Macro

Model” by Maureen Were and Stephen Karingi, Discussion Paper

KIPPRA, No.. , August 2002.

- This Paper ‘’Introduction to KTMM’’ seminar at ISS, 7 November 2002

The theory and estimation

papers are brought into sheet Manual and Theory in the Excel version of

the model, with hyperlinks between the equations in the model sheet and

manual sheet. The KTMM model file has not been published by KIPPRA so

far, but another Macroabc model, Curalyse, can be downloaded as

shareware from www.micromacroconsultants.com

|

Overview KTMM

The

KIPPRA-Treasury Macroeconomic Model (KTMM) model is an aggregate

supply/aggregate demand type of macro model of a market economy, and it

describes the behaviour of market actors. It consists of equations not

only from demand side but also from supply side. The model has been

made for the Kenyan Institute for Public Policy Research and Analysis

(KIPPRA) to analyze the effects of the economy on the Budget of the

Government as well as the other way around: the effects of the Budget

on the economy. It is a simultaneous model. The theoretical base of the

KTMM is described fully in Theoretical Base for the Kenya Macro Model,

KIPPRA Paper 11, October 2001). The model is demand driven in the short

run, with multiplier effects through consumption and investment. An

important assumption of the model is that any demand is actually met,

that is, it is assumed that the price system ensures that there is

always some excess capacity in the economy. High demand leads to high

capacity utilisation rates of capital and low unemployment rates,

however, which lead to wage and price increases. With the important

further assumption that the resulting inflation will decrease the

competitiveness of exports, causing a reduction in exports and then

lowering investments. In this way the model has a tendency to return to

equilibrium with ‘normal’ capacity utilisation and

unemployment rates in the medium and long run.

These

main feedback mechanisms in the real economy work through the

wage-price spiral and also the real exchange rate. For instance, an

increase in aggregate demand raises labour demand, reduces the

unemployment rate, raises wages and starts a wage – price spiral.

The resulting inflation causes a real appreciation, a reduction in

competitiveness and a reduction in exports. The drop in exports and

investment reduces demand again, until equilibrium is restored. An

important point to note is that even though total demand may be

stabilised in this way, the feedback mechanism may well change the

composition of demand. For instance, if the original increase in demand

came from an increase in government spending, the net result will be a

shift from exports and investment to government spending, resulting in

a government deficit and a current account deficit.

The model is well organized in blocks and sheets. In this overview we will introduce the main relationships.

We discuss the main relations in MODFI following the numbers in the diagram and box:

- The Flow Diagram of the Structure of KTMM

- Box with list main behavioural equations in KTMM

The

components of GDP: see the arrows in the diagram going to GDP, coming

from private consumption, investments, government consumption and

investments, exports minus imports:

The

real consumption growth follows real disposable income growth (with a

higher saving rate for the profit disposable income then that from

wages disposable income).

The

private investment level is explained by a combination of flexible

accelerator and net profitability (profits minus calculated interests)

plus the change in public investments.

Real

export growth: 80% of world trade growth + 2 * (world market price

minus export price). So one percent better competitiveness gives two

percent more real exports growth.

The

real growth of imports equals: 1,3* the final demand growth,

re-weighted with import intensities, minus 60% of difference of growth

of import prices and domestic prices. So a difference of one percent in

imports and domestic prices gives a half percent lower real

imports.

The

Prices are mainly explained from cost price developments: the wage

costs (wage rate minus trend in labour productivity), import price and

change in indirect taxes pressure. The coefficients for wage costs and

import price differ in the price equations for consumption, investments

and exports. The export price follows for 70 % cost price (wage

costs plus import price) and 30% competitors price , plus some effect

of real interest rate. Also the investments price is affected by the

real interest rate, and by the utilisation rate.

The

wage rate follows inflation, but with a lag and not for 100%.

Furthermore the wage rate is influenced by the trend in labour

productivity, and the pressure of direct taxes, and the growth of

employment.

Employment of businesses follows real GDP growth and is negatively affected by real wage growth.

In

the monetary side: the interest rate changes with 105 of the difference

between actual and targeted inflation. Because of this low coefficient

it is almost exogenous for the time being. The exchange rate equation

is based on a combination of purchasing power parity, interest rate

parity and exogenous shocks in the Balance of Payments. The money

supply equals real GDP growth plus the inflation target. This means

that Central Bank will sterilise all money created from abroad or by

government as far as it is more than the growth of real GDP plus the

targeted inflation. Please note that the interest equation shows an

increase if inflation is higher than the targeted level.

Next

diagram shows these relationships and the following box presents the

overview of formulas in behavioural equations (lags not

mentioned). So far the equations as they are in the actual KTMM.

How did we reach those results?

Which behavioural equations, what level of coefficients?

The

behavioural equations are identified in the initial theory paper and

estimated in the paper: ''Draft Estimation Procedure and Estimated

Results of the KIPPRA-Treasury Macro Model'', April 2000.

For

each of the equations (see the list of 12 main behavioural equations)

we needed a specification and levels of the coefficients. This is done

by an iterative process based on:

- The economic theory

- The estimation results

- Other studies (about Kenya and other countries and other Macroabc models)

- The simulation properties

The

initial theory paper (based on other Macroabc models and discussions in

Nairobi) provided the base for the estimations of the behavioural

equations. However before starting the estimations, we of course needed

to construct a database and consistency framework. A preliminary

database and consistency framework were made in the beginning of the

KTMM project, and then the estimation process started.

Estimations of the behavioural equations

The

twelve main behavioural equations have been estimated for the period

1972-1998. See the paper: ''Draft Estimation Procedure and Estimated

Results of the KIPPRA-Treasury Macro Model'', April 2000. The

(improved) text of this paper is in the sheet THEORY.

In

these estimates only explanatory variables from sheet MODEL are used

(otherwise we would not have values for the explanatory variables for

future years to make forecasts). During the estimation process we

needed some additional primary variables. They were added to the data

system. We did also add additional secondary variables to sheet MODEL,

because they can by definition be derived from the primary variables in

sheet MODEL. Only in a very special case we brought additional primary

variables into the system, to prevent that the model becomes too big.

For

every behavioural equation a research note has been made (with

description of theoretical background, estimation results and proposed

specification and level of coefficients in the model).

The results of the estimations brought into the sheet MODEL

When

the behavioural equations were estimated, as expected, always some

estimates are inconclusive. For example because the time series after

the regime switches in the beginning of the nineties are to short, or

because we don't have time series for some variables, or because the

confrontation with actual figures shows that the postulated theory does

not fit Kenyan reality. In that case we had to discuss the

specifications and levels of coefficients for example on base of

Macroabc models for other countries and simulation properties of some

specifications and levels of coefficients. Some estimates provide

coefficients, but with low significance, so high inaccuracy margins.

Also in that case we have to analyse the simulation properties: does

the model converge, does it give plausible results? These simulation

properties were analysed when the behavioural equations were brought

into the model and some forecasts with the model as a whole were made.

Actually,

also for the semi-behavioural equations we had also the check if they

give plausible results and a model that converges as a whole. But

these checks for each (semi)behavioural equation only can be made if

the model runs as a whole, with already the other (semi)behavioural

equations in the model. That is why we had constructed a test version

of the model. This test version had very provisional

specifications and levels of coefficients. Then we brought step by step

the coefficients in the behavioural equations, analysed the simulation

properties and discussed the whole. That resulted in the improved pilot

version of the model. Then we improved some parts of the model, and

then we had to look at the plausibility of the whole again. Etc. etc.

At the end this process converged into the KTMM version of August 2000,

the first operational version. And afterward every year the model is

updated and improved and tested again.

We followed five rules in bringing the behavioural equations in the test version:

- Each

coefficient has only one figure behind the comma (to demonstrate that

these parameters are not that accurate). Some insignificant

coefficients are left out.

- We avoided to bring constant terms into the equations (because of the

bad simulation properties in longer term projections)

- Those coefficients that actually represent shares, are chosen on such levels that their sum adds to 1,0

- The capacity rate is only in the investment price used as explanatory variable.

- Some

additional variables were used in the estimation process, but they are

not in the model. In those cases we used a familiar variable

This resulted in the formulas and coefficients in the behavioural equations, see table on next page.

We

can look at the plausibility of the forecast results, not only

concerning the variable in the equation under construction, but also

the effects on all other variables. Furthermore we can also look at the

results compared to a reference path (base line). The model has a block

in which the results of an actual run are automatically compared with

the results of a reference path (frozen values) for all variables in

the sheet Model.

Next

diagram shows these relationships and the following box presents the

overview of formulas in behavioural equations (lags not mentioned).

Then we will discuss the main sheets of the model.

|

The Flow Diagram of the Structure of KTMM

Figures refer to equation numbers in Box of main behavioural equations

|

Box: List main behavioural equations in KTMM

(Lags not mentioned)

Components of GDP:

- Consumption: changes with disposable income (98% wages, 96% profits) (lags)

- Private investments volume growth: flexible accelerator (weight 50%)

and profits minus interest (weight 50%) and crowding-in: 0,3*(1+2*GDP

real growth) +0,4*(disposable profits income minus long interest

rate*invested wealth)+0,3* public investment - 0,4*public investment

five years lagged -0,06*change in credits.

- Export volume

% change: 2* (world market price minus export price) + 0,8* world trade

growth (lagged) + 0,2* % change in investment/GDP rate.

- Import volume % growth: 1,3*real final demand growth - 0,6* (import price minus consumption price)

Prices:

- Consumption price % change: 0,7* wage costs + 0,3*import price + 100% change in indirect tax pressure,

- Export price % change: 0,4* wage costs + 0,3*import price +

0,3*competitors price + 0,2*real interest rate +change in indirect tax

pressure,

- Investment price % change: 0,5* wage costs +

0,5*import price + 0,4*(capacity utilisation rate -1) + 0,1* real

interest rate (t-1),

- Wage rate businesses: 5 +

0,8*consumer price +0,7*labour productivity trend + 0,4* increase

pressure direct (wage) tax rate + 2* increase wage employment

businesses +(for the time being - 0,05*informal sector rate and -0,1

increase in informal sector rate)

Employment

- Employment businesses % change: -0,4* real wages + 0,8* real GDP

growth; Informal sector number % change: For the time being we take:

+0,6*population % growth -0,6* employment % growth,

Monetary variables:

- Interest rate: changes with 0,1*(consumption price change minus inflation target (exogenous),

- Exchange rate changes: +1,0*(domestic minus foreign % change in prices,

five years moving average) +0,3*(domestic minus foreign interest rates

changes),

- Money supply: increases with 0,9*Real GDP growth and 100% inflation target

|

|

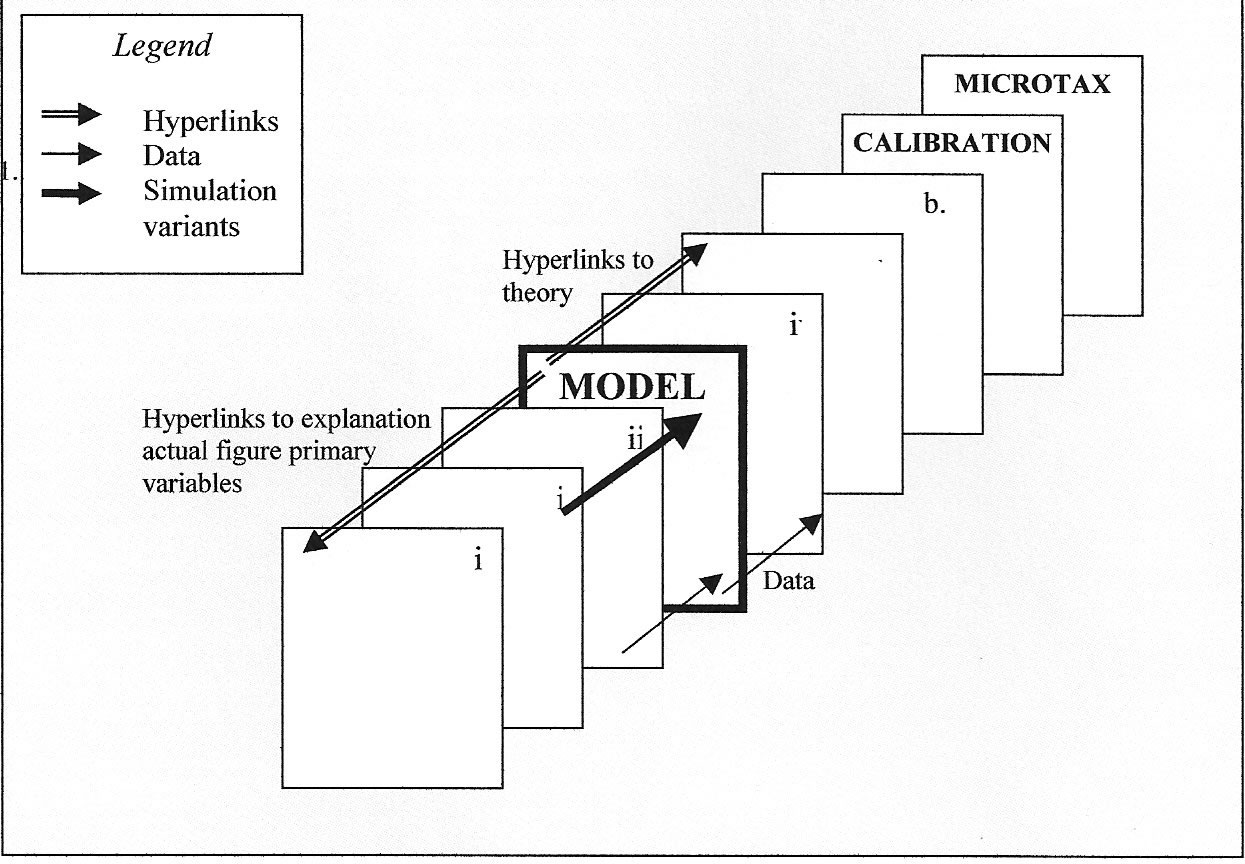

Sheets of the Kenya Macroabc Model

The Excel file with the Kenya Model (KIPPRA-Treasury Macro Model) consists of:

- Sheet MANUAL: contains a detailed manual organized in blocks:

- Design of the consistency framework

- Discusses every sheet of the model

- Discusses calibration results of all semi-behavioural equations

- The specification and coefficients of all behavioural equations

- How to run a simulation

- Sources and literature list

- Micro simulation for average marginal wage tax rate

- Activities performed during the construction stage of the model project.

- Sheet HELP: variants for fifty variables, ready to be used in all kind of combinations of variables and years.

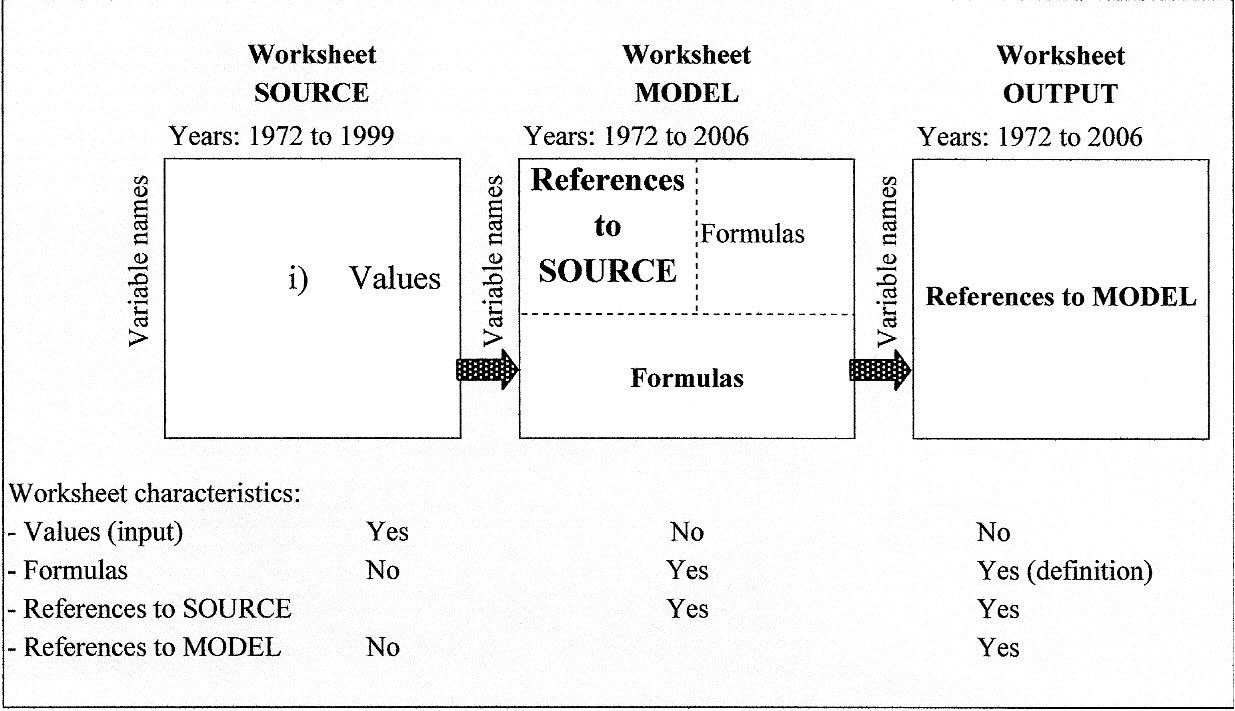

- Sheet SOURCE: contains

the information about macro time series that we gathered from several

sources. Column A gives the name of the time series, column B the unit

and column C and D indicate the source. Column E and subsequent columns

display calendar years, starting with 1971. These columns contain the

values from the different sources. Sheet SOURCE does not contain any

formulas!

- Sheet MODEL: its

Northwest quadrant contains cells with values of the so-called primary

variables for the years in the past. All these values are calculated by

formulas or references only using information from sheet SOURCE. The

Northeast quadrant contains formulas that calculate future values for

the primary variables. The cells in the Southern part of the sheet

Model contain help variables (also called auxiliary variables) their

value is calculated by formulas using only information from the primary

variables above in this sheet. These help variables are used as

explanatory variables in the (semi-) behavioural equations. So the time

series in sheet MODEL contain all time series that are needed to

estimate the behavioural equations and to calibrate the

semi-behavioural equations. Sheet MODEL does not contain any input of

values (other than calculated by formulas or references to sheet

SOURCE. In column C of sheet MODEL you can click in each row (variable)

to go immediately to the relevant part of sheet Manual where you will

find background information concerning that variable.

Scheme of the Kippra-Treasury Kenya Macro Model (KTMM)

Table: Main worksheets of Kenya Model

Table: Overview of all sheets in KTMM

- Sheet HISTAN contains time series and graphs to analyse the relation between variables.

- Sheet OUTPUT contains

the output of the key variables (in calendar years). All output

variables are calculated using values from sheet MODEL and no other

sheet. The OUTPUT sheet gives the variables in different presentations:

- Selected Annual Economic Indicators (in the format of CBK as far as possible),

- Uses of Resources in format SNA of CBS,

- Monetary Survey (consolidated accounts of the banking system) in format CBK,

- Institutional Sector Accounts (flow of funds between institutional sectors)

- Labour Market Survey

- National Resources and Expenditures

- From Disposable income via consumption and investments to financial transactions

- Simple Social Accounting Matrix (SAM)

- Central Government Revenues, Expenditures and Fiscal data.

- Sheet FY: the same

information as in sheet OUTPUT for Calendar Years for the Central

Government also for Fiscal Years. In sheet FY is, unlike in sheet

OUTPUT, also information used from another sheet than MODEL. In this

sheet we use also information from sheet SOURCE,

- Sheet THEORY: This sheet contains the text of the first theory paper,

- The sheet CALIBRATION

contains for each (semi)behavioural equation a graph with a comparison

of the actual figures of the historical time series, and the

simulations based on the forecasting formula, using the realised,

actual figures for the explanatory variables,

- The sheet TAX contains

the calculation of the average marginal wage tax rate, based on the tax

rates per bracket and a division of wage earners to income brackets,

- The sheet MICROEXPORT contains micro data for tea and coffee, to be used for the break down of the export equation,

- The sheet ADD-FACTOR contains the add-factors that are in use in the (semi) behavioural equations in sheet MODEL,

- Sheet sectors gives a breakdown of forecasts to production growth of sectors of industry,

- Sheet IMF OUTPUT gives some of the output variables in IMF format,

- Sheet decomposition

gives a breakdown of the forecasts for main variables to the

contribution of each explanatory variable. This sheet makes analyses of

forecasts and variants more easy,

- Sheet MONITOR gives

monthly information concerning CPI etc. and a calculation scheme to

judge the plausibility of the forecast of the running year, given the

already available monthly figures and trends,

- Sheet LOGBOOK is used to document all changes in the model that are brought into the most recent official version of the model.

|

How to run a simulation, some examples

What

will be the effects on the economy and government finance if wages get

an impulse of additionally 2% each year, starting in 2003?

Start the PC, go in Excel, read KTMM.XLS, then you have two ways to run a variant, in sheet MODEL or in sheet HELP.

- Go to sheet MODEL, Go to

cell AK35, change the 3 before +HELP in 5, enter, copy cell AK 34 to

AL34 .. AO 34 (otherwise the impulse is only in the year 2003). Push F9

(for recalculation if the default is not on ''automatically''). Then

look at the results: in AQ244.. AU244 you read the wage bill in this

simulation variant minus its value in the base line. Look in AK.. AO to

see the level of the wage bill in this simulation run. See the effects

to the wage rate in sheet OUTPUT, AQ38 – AU38 and AK38 AO38. Have

also a look to the changes in other key variables.

- You can also run this simulation by setting in sheet HELP AK34..AO34 on 2.

What will be the effects on government finance and the economy of 10% increase of the VAT of local manufactures?

Go to cell AK67 in sheet MODEL. Edit (F2) the formula in that cell:

multiply with 1,10. (Do not copy this to the right of this cell, unless

you want to increase the revenues of these taxes year after year with

10%). Push F9 for recalculation and then go to see the results in

AQ67..AU67, and analyse the other differences with the base line in

columns AQ..AU in sheet OUTPUT

What will be the effects on government finance and the economy of 10% increase of the corporate income tax?

Go to cell AK77 in sheet MODEL. Edit (F2) the formula in that cell:

multiply with 1,10. (Do not copy this to the right of this cell, unless

you want to increase the revenues of these taxes year after year with

10%). Push F9 for recalculation and then go to see the results in

AQ77..AU77, and analyse the other differences with the base line in

columns AQ..AU in sheet OUTPUT

What will be the effects of 10 % higher exchange rate level in 2003 on government finance and the economy?

Go to cell AK142 in sheet HELP and change zero in 10. Check what

happens in MODEL row AW142. Then see the effects in deviation of the

base line in column AQ..AU in sheet OUTPUT. |

|

|

|