|

European Union - Euralyse

Table of contents:

|

Introduction

Euralyse is a macroeconomic

model of the European Union as a whole. The model structure is more or

less similar to the structure of Macroabc, a macroeconomic model for

the Netherlands. More information on Macroabc is available in Dutch at

the homepage of Micromacro Consultants (Follow the link Draaiboek

Macroabc or click here).

Euralyse consists of all macroeconomic variables occurring in Macroabc,

plus extra variables like short and long rate figures, the exchange

rate and an European index for the stock market.

It is the impression of Micromacro Consultants (MMC) that these

financial variables can not be forecasted properly and unconditionally.

In other words: we prefer to leave this area to diviners and technical

analysts. It is as difficult to forecast precisely interest and

exchange rates as to predict the amount of millimetres rain to be

fallen in Brussels tomorrow. However, it is a common fact that the

average temperature in Brussels is significantly lower in December than

in July. In the same way, Euralyse does not predict interest and

exchange rates. Instead, Euralyse will show in which ways these

quantities influence the economy and vice versa, the ways in which the

economy can affect such variables.

Macroabc is designed as a tool for Dutch economists specialised in

macroeconomic analysis. Euralyse, on the contrary, will be made

accessible to a far larger public. Two model version will become

available: a scientific version intended for European macroeconomists

and a popular version. In the scientific version the user is assumed to

master the model completely and to run simulations on the basis of

his/her own insights.

The popular version of Euralyse contains a 'peel' enabling users to

start with simulations without studying the model as a whole. You can

work with this user-friendly version of Euralyse in case you do not

wish to absorb all details of the model relations and its variables.

It is not possible to determine scientifically the scenario approaching

the realisation figures most closely. That is why the popular model

version will present the results of twenty variants for several

scenarios.

Furthermore, Euralyse will supply historical data series for all main

macroeconomic variables of the European Union, consisting of fifteen

member states. These time consistent series allow you to compare your

simulations with developments in earlier years.

Euralyse will be presented in December 1999 during a workshop on

European macroeconomics. Next year we intend to develop a self

explaining slide show on CD-rom.

We would be pleased to inform you when the English version of this

CD-rom will be available. If you wish so, please send us your e-mail

address and you will be acquainted without any obligations.

Furthermore, we are looking forward to receive any questions, comments

and suggestions you might have. |

What is Euralyse?

Euralyse is a macroeconomic

model of the European Union based on the Macroabc methodology of MMC.

This is a flow of fund model based on the core of the large

macroeconomic models of CPB. The database stems from the Organisation

for Economic Growth and Development (OECD) after CPB improvements.

A first version of the model

is already presented in workshops in December 1999. However, the work

on the scientific version has to be finalised yet. After finalisation,

one can use Euralyse in research analysis, historical simulations,

policy simulations, forecasting and monitoring of the European economy.

The model is kept as simple as

possible deliberately and is very easy to handle. However, it contains

the most important economic relationships. With the help of a manual

you can teach yourself to run the model by yourself, using data of the

European Commission (EC), Eurostat and the Organisation for Economic

Cooperation and Development (OECD). The prerequisites necessary to run

Euralyse successfully are a sound knowledge of economics and some

experience using spreadsheets on a personal computer.

Euralyse can be a useful tool in a whole range of activities. Examples are:

- Policy variants:

calculate yourself what will be the economic consequences of exogenous

changes (international inflation etc.) on the economy: what are the

effects on the economy if total wage costs will be 1 per cent higher

than the European Commission is predicting? What will happen if the

interest rate will be one per cent higher?

- Historical analyses: in

which way did the European economy develop itself in the past and in

comparison with now? Euralyse contains consistent time series from 1975

to today.

- Medium term and long

term simulations: you can easily design a new medium/long term path of

reference for the period 1999 to 2020 or even further ahead. You can

use that new path as a basis for scenarios.

Since the Second World War

Europe is integrating continuously. Especially the start of the

European Monetary Union in 1999 brings the EU member states even closer

together. It is against this background that we started to build a

model for the European Union using the Macroabc technology. We consider

the European Union as one ‘country’ in order to obtain

comparable data.

Euralyse can be applied as an aid with research analyses and scenario building.

|

Background of Euralyse

The structure of

Euralyse stems from Macroabc, a macroeconomic model for The Netherlands

developed by Micromacro Consultants. The methodology of Macroabc

consists of constructing an analytical framework that uses the data

from a compact macroeconomic database.

Macroabc is an integrated

data, forecasting, and simulation model based on the core of the macro

models of the CPB. It is a so-called aggregate demand, aggregate supply

model (AD-AS model) that combines modern macroeconomic theory with

pragmatic modelling. It is easily adapted to fit the institutional and

behavioural relationships in other countries. The macro models of

Surinam ‘Macmic’, of Curaçao ‘Curalyse’ of Poland ‘M98D’ and Kenya

(Kenyabc) are based on the Dutch Macroabc methodology. The ability to

run a model in a standard spreadsheet increases an accessibility of a

model. In particular, because the spreadsheet models do not require

intensive and specialised training in detailed computer programming

languages, policy experts can participate more in model construction

and execution.

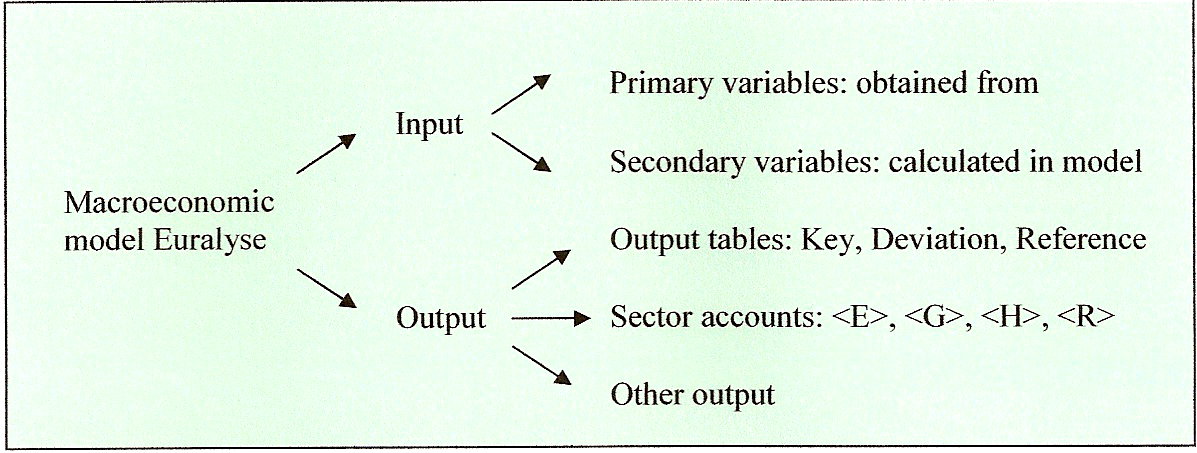

The essence of Euralyse is that the whole

spreadsheet of some 1000 lines is being filled on the basis of 57

primary variables only. On the basis of these primary variables the

secondary variables are calculated.

The model output consists of

several output tables, sector account and other tables. Since Euralyse

is available in Excel’97 format, the model is quite accessible.

Figure 1.1: Rough sketch of Euralyse

|

Main Structure

An

economic model in spreadsheets is very flexible and useful since

changes are easy to make. However, flexibility can take a turn into

chaos. You run the risk of loosing the survey. You have to take care

yourself of the arrangement in spreadsheets. That is why it is

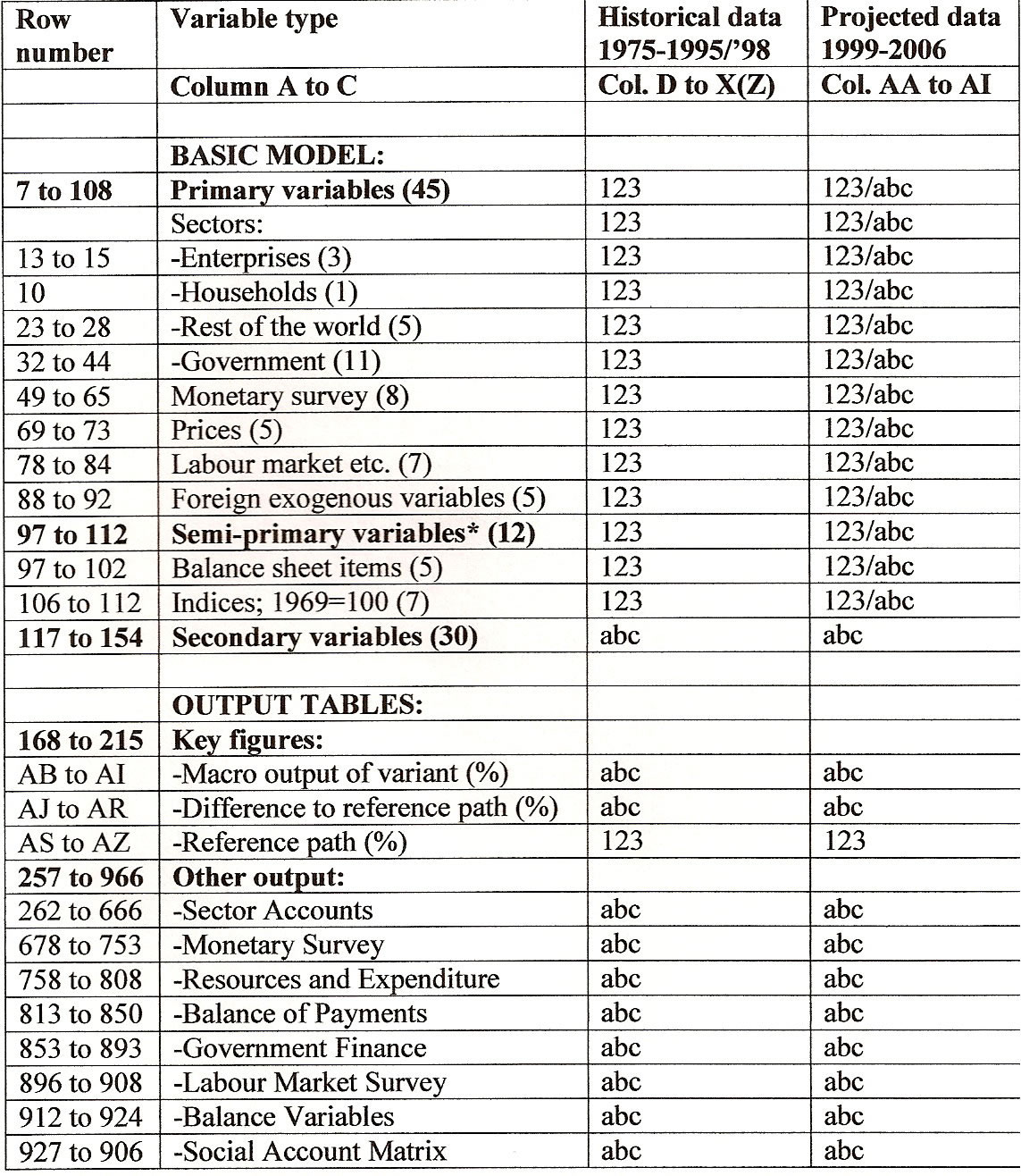

important to keep the schedule at hand. Table Schedule gives you a

first impression.

They can be found in lines 7 to 112. Values of these variables are

based on figures of European Commission, Eurostat, ECB, OECD, CPB and

IMF and on estimates of the CPB in accordance with its Quarterly

Bulletin. Values (indicated with 123 in table 2.1) of the 57 primary

variables for the period 1975 to 1995 are already filled in by MMC.

Then all following lines are filled in automatically on the basis of

formula calculations of the model (indicated with abc in table 2.1).

Formulas for 1999 are calibrated to deliver the same results as offical

prognoses. From these data and with help of formulas estimates will be

made for the years following 1999.

Schedule of Euralyse and its construction.3

|

(Semi) Behavioural equations

As

noted above, behavioural variables are calculated on the basis of other

variables in the spreadsheet and on the basis of behavioural

coefficients. The values of the behavioural coefficients are based on a

combination of time series analysis, economic theory, feasibility of

model results, and comparative studies. In the case of economies in

transition, historical research must be completed with these latter

components because the transition process affects behavioural

relationships, causing a structural change in the time series. If

possible, evidence from other countries assists the calibrations of the

present local statistics.

Below is a discussion

of the most important behavioural equations, and their significant

explanatory variables. The intention of the list below is to give an

idea of a starting point for discussions between the project team and

the counterparts.

- The export price is a function of import prices and wage costs.

- The change in the

quantity of exports is a function of the change in world trade, the

difference between export and import prices and production

capacity.

- Investments in industries are a function of gross value added of industries.

- The change in the value of consumption is a function of disposable income of wage earners and profits.

- The change in the

quantity of imports is a function of final output and import shares and

the difference between internal and external inflation.

- The growth of employment

in industries is a function of growth of the components of final output

and the corresponding labour intensities and relative wage costs.

- The change in unemployment rate is a function of demand for labour and the increase in labour supply.

- The change in the price of investment goods is a function of the change in costs.

- Money growth is a function of the monetary financing by government and the surplus on the balance of payments.

- The change in wage follows the consumption price and the change in unemployment.

- The change in the consumer price is a function of the change in costs and the change in the indirect tax rate.

The institutional or

semi-behavioural equations reflect the current institutional setting of

the country. Some of the most important equations of this type are:

- Import duties is a function of the value of imports and the average import duty rate.

- Taxes on consumption are a function of value of consumption and the VAT rate.

- Direct taxes on industries are a function of disposable profit income and the profit tax rate.

- Direct personal income tax is a function of disposable income and profits.

|

What has to be done?

A first version of Euralyse is

running and has been presented in workshops in December 1999 in The

Hague. However, a model is a living being and improvements never end:

- Research in improvement

of main equations: exchange rate, wage formation, investments. Study of

recent literature on these subjects. Comparison with models of IMF,

OESO, EU.

- Discussion of the first model version with colleague researchers.

- Documentation and full

description of the model following scientific standards: what's new in

Euralyse compared with other models? What are its weaknesses?

- How to use Euralyse

(model EU15) in combination with macro models of EEC countries, with

the Polish Macroabc model as an example.

- Construction of a version of Euralyse for the Euro area, using the new OESO database.

- Last but not least: use the model as an auxiliary in some research studies

|

|

|

|